It’s important to be able to trust that the funds you provide to charities are going to be utilised appropriately to achieve the mission of the organisation. Whilst it’s only one part of the impact picture, reviewing a charity’s financial statements as part of your due diligence is good practice. Financial statements offer insight into how a charity manages its resources, sustains its operations, and delivers impact. By reviewing these documents, givers can assess whether an organisation is financially healthy, transparent, and aligned with its stated mission.

How can I access a charity’s financial information?

Charities registered in Australia are required to submit annual financial reports to the Australian Charities and Not-for-profits Commission (ACNC). Visit the ACNC Charity Register and search for the charity by name or ABN. The Financial Documents tab has both the summary Annual Information Statement, and the detailed Financial Reports.

What should I consider when reviewing financial accounts?

To review the financial accounts of a charity, start with the audited financial statements, which typically include:

- Income Statement (Profit & Loss) – shows revenue and expenses

- Balance Sheet (Statement of Financial Position) – shows assets, liabilities, and equity

- Cash Flow Statement – shows how cash is generated and used

- Notes to the Accounts – provides context and detail

How do I assess a charity’s financial health?

When assessing a charity’s financial health, it helps to focus your questions on these key areas: revenue sources, expenses, assets, and working capital. Understanding how diversified their funding is, the efficiency of their programs, and their capacity to meet obligations provides valuable insights for your giving decisions. Below are example questions that can frame your conversations with a charity.

Revenue: Donations, grants, government funding, investments, service income

Questions to ask:

- Is revenue diversified or reliant on a few sources?

- Are there any significant one-off grants or donations?

- Is revenue growing, stable, or declining?

Expenses: Program delivery, administration, fundraising, salaries

Questions to ask:

- Are the costs reasonable and effective?

- Are there any unusual or unexplained expenses?

Assets: Cash, investments, property, equipment

Questions to ask:

- Does the charity have sufficient liquid assets (e.g. cash)?

- Are assets being used effectively to support the mission?

- Are there any restricted assets?

Working Capital: Current assets minus current liabilities. Indicates short-term financial health and ability to meet obligations.

Questions to ask:

- Is working capital positive and sufficient?

- Are liabilities increasing faster than assets?

- Is the charity at risk of cash flow issues?

If you're unsure, reach out to the charity directly. They'll likely welcome the opportunity to clarify or provide context around their financial reporting.

Case study: Happy Paws Happy Hearts

Happy Paws Happy Hearts brings socially isolated individuals—such as those with disabilities, mental health challenges, veterans, and first responders—together with rescue and wildlife animals in shelters and online, to provide hands‑on care, training, and rehabilitation support for both participants and animals. Their tailored programs foster personal development, build confidence, reduce isolation, and help prepar e animals for adoption or release, creating meaningful connections that benefit people and pets alike.

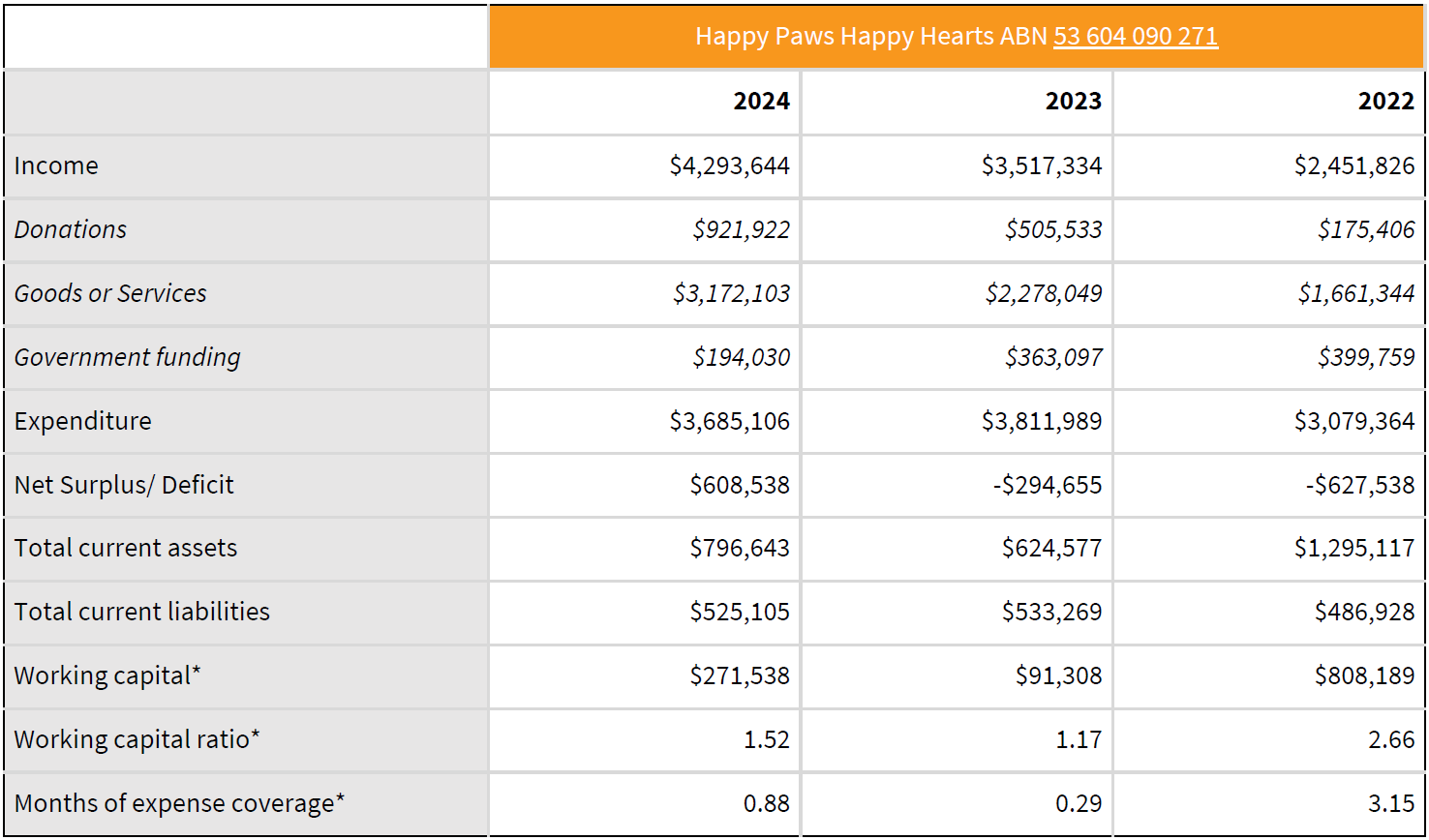

The table below shows a summary of key data points taken from Annual Information Statements

Analysis & commentary on financials

The Australian Philanthropic Services (APS) team reviewed the financial reports and spoke to Happy Paws Happy Hearts about their work to understand the why behind the numbers.

- Happy Paws Happy Hearts maintains a well-diversified revenue base, combining philanthropic donations, government support, and earned income through a social enterprise model. Programs are contracted through multiple channels, including the National Disability Insurance Scheme (NDIS), the Department of Veterans’ Affairs, and WorkCover, enabling broad access and financial sustainability.

- In 2021, the Paul Ramsay Foundation provided a significant social impact loan to support the organisation’s scale-up strategy. Structured as a 10-year liability on the balance sheet, the loan enabled targeted investment in operational efficiencies and expansion of reach and impact.

- As a result of these strategic investments, the organisation operated at a substantial deficit during the 2022–2023 financial year. Unfortunately, some donors interpreted the financial statements at face value and perceived the deficit as a risk, choosing not to continue their support. However, donors who engaged directly with the organisation to understand the context recognised the long-term strategy and opted to continue funding, supporting the growth and impact of the organisation.

*Calculations based on information submitted. Ratio and expense coverage (working capital/ 12) are a guide only. Monthly expenses will fluctuate between fixed and variable. Ideally a charity will have 3-6 months expense coverage.

As a client of APS, our Giving Services team can help you access and understand your charity partner’s financial health. Get in touch with APS Giving Services by calling 02 9779 6334 or sending an email to giving@australianphilanthropicservices.com.au.